Available Assets

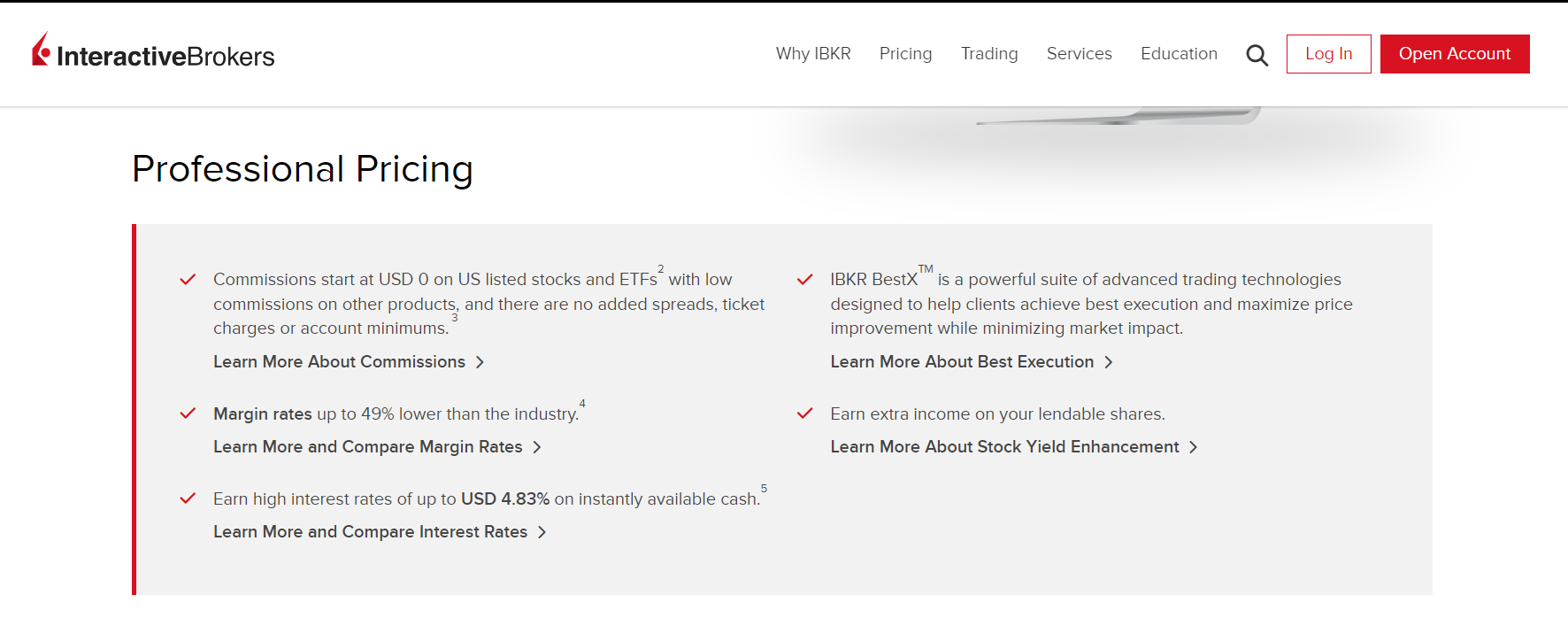

Fees & Commission

Trading Platform

Tools and Features

Licensing & Regulation

Educational Materials

Account Types

Customer Support

Deposits & Withdrawals

- 1. A TopBrokers360 Interactive Brokers Review for 2025

- 2. Pros and Cons

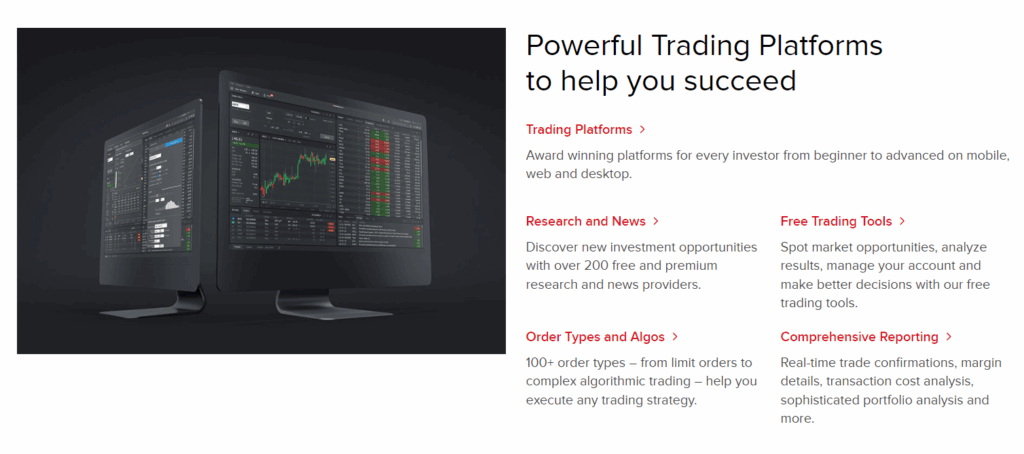

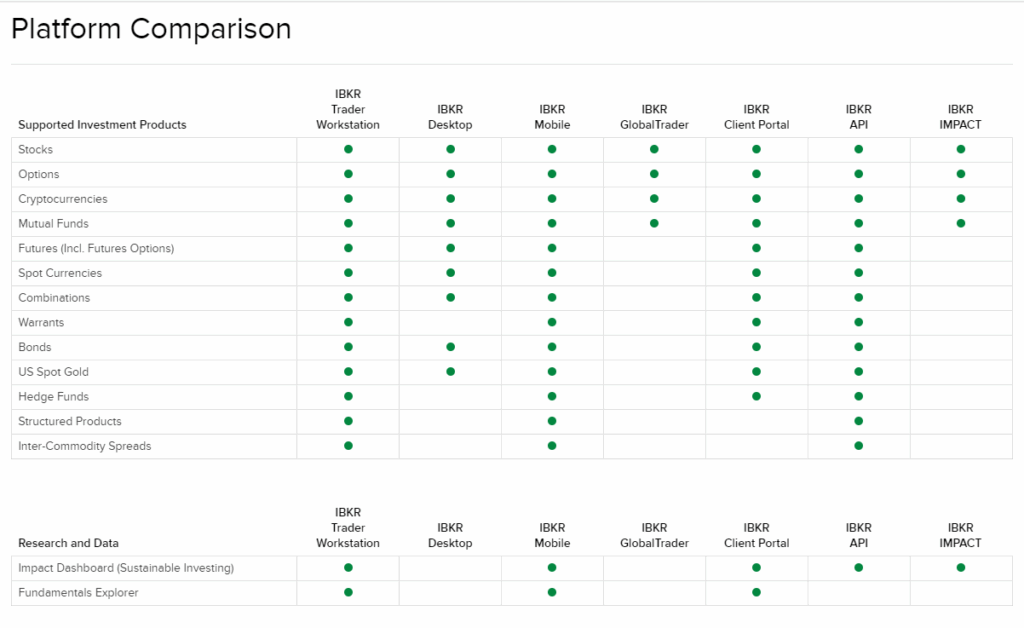

- 3. Interactive Brokers Feature-Rich Platforms

- 4. IBKR Products Review Review

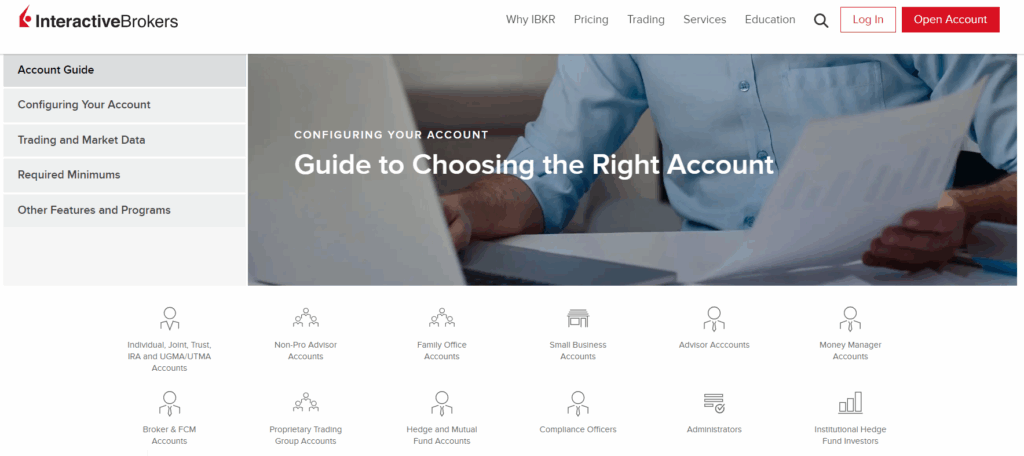

- 5. Comparing the Trading Accounts

- 6. Compliance & Regulation | Is Interactive Brokers Safe?

- 7. IBKR Payment Methods & Funding

- 8. Well-Rounded Support

- 9. Wrapping Up the Interactive Brokers Experience

- 10. Frequently Asked Questions

A TopBrokers360 Interactive Brokers Review for 2025

Interactive Brokers (IBKR) was established in 1977 by current chairman Thomas Peterffy and is headquartered in the United States. Interactive Brokers has evolved into a titan of the trading industry, known for its innovative approach and expansive reach. As a trailblazer in the field, IBKR offers an impressive array of trading options, providing investors with access to a diverse range of markets across the globe.

From humble beginnings, Interactive Brokers has grown into a key player, offering both individual and institutional clients a platform where they can trade stocks, options, futures, forex, bonds, funds, and more. What sets IBKR apart is not just the variety of available assets, but also its commitment to providing cutting-edge trading technology. This broker is a one-stop shop for traders looking for a comprehensive, efficient, and secure trading environment. With its global reach and robust technological infrastructure, Interactive Brokers stands out to those seeking a dynamic and efficient trading experience.

IBKR combines decades of expertise with a forward-thinking approach to investment. As we dive deeper into this Interactive Brokers review, you will discover why they are a top choice for traders who demand excellence, variety, and innovation in their trading journey.

Pros and Cons

Pros:

- Extensive Range of Products

- Advanced Trading Tools

- Competitive Low Fees

- Global Market Access

- Robust Regulatory Compliance

Cons:

- Complex Platform Navigation

- Limited Customer Support Responsiveness

Interactive Brokers Feature-Rich Platforms

Image source: Interactive Brokers Platforms

IBKR Trader Workstation (TWS)

A flagship desktop platform designed for seasoned, active traders who require power and flexibility. Allows trading of stocks, options, futures, currencies, bonds, and funds on over 150 markets worldwide from a single unified platform.

IBKR Desktop

A user-friendly desktop trading platform designed for beginner to intermediate traders who appreciate a more streamlined interface. Enables trading of stocks, options, futures, and more on over 150 markets worldwide with great pricing, order execution, research, and market data services.

IBKR Mobile

Designed for experienced traders who need the power to trade a wide range of assets across global markets. Provides access to advanced order types and trading tools on the go.

IBKR GlobalTrader

Offers a streamlined experience for beginner to intermediate traders to trade stocks, ETFs, options, and crypto worldwide. Allows for low-cost investing and offers a simulated trading account for practice.

IBKR Client Portal

An easy-to-use web platform for all trading experience levels that provides access to all necessary features. Allows viewing, trading, and account management with a single login, without the need for downloads.

IBKR APIs

Offers a range of APIs for all experience levels. Includes an easy-to-use Excel API and an industrial-strength FIX API. It is well-supported with numerous examples to help traders get started with algorithmic trading.

IBKR IMPACT

A mobile app available on iOS and Android devices. Allows users to invest in companies that align with their values, including options and cryptocurrencies. Provides a convenient way to make socially responsible investments.

Image source: Interactive Brokers Platforms

- Extensive Product Access Across Global Markets

- Real-time Market Data

- Advanced Charting with Technical Analysis Indicators

- Risk Management and Portfolio Analysis Tools

- Algorithmic Trading Capabilities

- Mobile Trading for Flexibility

- Secure and User-friendly Interfaces.

- Customizable Watchlists

- Access to Account Information on the Fly

- Options for API Trading and Algorithmic Strategies

IBKR Products Review

Interactive Brokers prides itself on offering a wide array of investment choices, ensuring that traders and investors have access to a wide variety of instruments and products. If you are interested in stocks, options, futures, forex, bonds, or funds, IBKR has you covered. With over 150 markets worldwide, you will find a multitude of opportunities to diversify your portfolio and explore different asset classes.

CFD Instruments:

Stocks: Trading in shares of public companies across global exchanges.

Options: Contracts giving the right, not obligation, to buy or sell an asset at a specific price.

Futures: Financial contracts obligating the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and price.

FOPs (Futures Options): Options on futures contracts, combining the benefits of futures and options.

ETFs (Exchange Traded Funds): Funds tracking indexes, commodities, or baskets of assets like an index fund but traded like a stock.

Warrants: Derivatives granting the right to buy the underlying stock of the issuing company.

Structured Products: Pre-packaged investments typically linked to an index or basket of securities.

SSFs (Single Stock Futures): Futures contracts with individual stocks as their underlying assets.

Currencies: Foreign exchange trading across various currency pairs.

Indices: Trading on various global stock market indices.

Fixed Income: Investments like bonds that return a fixed payment over time.

Mutual Funds: Investment programs funded by shareholders trading in diversified holdings.

CFDs (Contract for Differences): Contracts paying the difference in settlement price between open and closing trades.

Comparing the Trading Accounts

➟ Find the perfect trading account with Interactive Brokers

For Individuals, accounts range from personal ones for sole users to specialized accounts like IRAs, catering to U.S. clients’ retirement planning. There’s also the UGMA/UTMA for minors in the U.S.

For Institutions and Groups, options include accounts for small businesses, family offices, and groups of up to 15 members like the Friends and Family account. Professional advisors and money managers can also find accounts suited to their specific roles in client management and investment.

Image source: Choosing the Right Account

For Individuals:

Individuals: Single User Account.

Joint: Shared by Two Users.

Trust: Managed by a Trustee.

IRA: Retirement Account (U.S. Clients Only).

UGMA/UTMA: For Minors (U.S. Clients Only).

For Groups and Institutions:

Friends and Family: For Groups up to 15 Members.

Family Office: Managed by a Family Office Manager.

Small Business: For Small Corporations.

Advisor: For Managing Client Administration and Money.

Money Manager: Hired by Another Advisor.

Compliance & Regulation | Is Interactive Brokers Safe?

IBKR, renowned for its robust regulatory framework, exemplifies its commitment to compliance and safety in trading. As a global entity, it adheres to stringent regulatory standards, overseen by bodies like the SEC, FINRA, NYSE, and FCA, ensuring a secure trading environment. This dedication to compliance underpins its mission to provide liquidity and competitive trading terms. Trust in Interactive Brokers is bolstered by its investment-grade rating from Standard & Poor’s, reflecting its financial stability and reliability as a trading partner.

IBKR Payment Methods & Funding

Interactive Brokers simplifies the process of funding your trading account with a variety of methods. You can choose from direct electronic transfers like ACH (Automated Clearing House) for easy and automated transactions, or opt for traditional methods such as check deposits. They also accommodate wire transfers for rapid movement of funds. For clients in Canada, options like Canadian Bill Payment and EFT (Electronic Funds Transfer) are available, ensuring flexibility in funding methods.

One noteworthy feature is the emphasis on security and compliance, especially in the case of third-party deposits, which are generally discouraged due to fraud and money laundering risks. This approach underscores Interactive Brokers’ commitment to maintaining a secure and trustworthy platform for its clients.

Well-Rounded Support

Interactive Brokers (IBKR) offers a well-rounded support system including phone support, live chat, email assistance, and an extensive FAQ section. However, it is important to note that while the support team is knowledgeable and helpful, clients may experience longer waiting times across these channels. The live chat and phone services, while accessible, might not provide immediate responses, and email queries can take up to a couple of days for a reply. This can be a bit of a hurdle, especially for traders who require quick assistance.

Despite the wait, the quality of support provided by Interactive Brokers is generally high. The team is adept at offering clear, detailed answers to a wide range of queries, from account management to trading issues. This level of expertise is a significant plus for users who seek thorough and reliable assistance. However, for those who need faster responses, the extended waiting times could be a point of consideration.

Image source: Interactive Brokers Individual Support 2025

Contact form:

Contact form

Telephone:

1 (877) 442-2757 (Toll-Free in the United States)

Wrapping Up the Interactive Brokers Experience

Interactive Brokers, established in 1977, has grown into a prominent global trading platform renowned for its diverse product offerings and cutting-edge technology. While it excels in providing access to a wide range of markets and maintaining competitive low fees, the platform’s complexity and customer support response times may pose challenges for some users. Nonetheless, for traders who value advanced tools, global market access, and robust regulatory compliance, Interactive Brokers stands out as a comprehensive and cost-effective choice.

Frequently Asked Questions

1. What is Interactive Brokers?

Interactive Brokers (IBKR) is a comprehensive online trading platform offering a wide range of investment products. Known for its low fees and advanced technology, it caters to both casual and active traders globally.

2. How can I log in to my Interactive Brokers account?

To log in to your Interactive Brokers account, visit their website and click on the “Log In” button. You will need your username and password. If you encounter any issues, their customer support can assist you. Log in here.

3. Is IBKR safe for trading?

Yes, Interactive Brokers is considered safe. It is regulated by top-tier financial authorities and offers enhanced security features for client accounts. However, as with any trading, there is always a risk involved.

4. Who owns Interactive Brokers?

Interactive Brokers Group, Inc. (IBKR) is a publicly traded company, meaning it is owned by its stockholders. The largest shareholder is the company’s founder and Chairman, Thomas Peterffy, who, as of March 2021, holds more than 72 million shares, approximately 16.5% of the company’s outstanding shares. The rest of the ownership is distributed among individual and institutional investors, including major institutional stakeholders like The Vanguard Group, Inc., and BlackRock, Inc. The company is listed on the NASDAQ stock exchange under the ticker symbol IBKR. This information reflects the diverse and public nature of the company’s ownership structure.

5. What are Interactive Brokers' margin rates?

Interactive Brokers offers some of the lowest margin rates in the industry, which vary based on the market and the amount borrowed. You can find the latest rates on their website. Margin rates.

6. What types of trading accounts does Interactive Brokers offer?

IBKR offers accounts for individuals, institutions, and financial advisors, including individual, joint, IRA, and trust accounts. Account types.

7. What products does Interactive Brokers offer for trading?

Their product range includes stocks, options, futures, forex, bonds, ETFs, and more, catering to a global clientele. Product offerings.

8. How does Interactive Brokers' IBKR Mobile app work?

IBKR Mobile is a comprehensive trading app that allows clients to manage their accounts, trade, and access research and tools on the go.

9. How do I review my investments with Interactive Brokers?

You can review your investments via the Interactive Brokers trading platforms, which provide detailed reports and analytics on your portfolio.

10. Can I trade global markets with Interactive Brokers?

Yes, Interactive Brokers offers access to over 135 markets in 33 countries, enabling global trading opportunities.