When is Q1 2024?

As we navigate through the calendar, the answer marks the period from January to March, a time that has unfolded as a whirlwind of activity across the financial markets. As we close the book in the first quarter of 2024 and start to look towards the second quarter, it is essential to reflect on how the key events and trends from Q1 might shape the upcoming quarter. From the stock market's fluctuating fortunes to the unexpected shifts in commodities, alongside the twists in forex and crypto markets, Q1 has certainly set an intriguing stage for what’s next.

Join us as we dissect the pivotal moments of the first quarter of 2024.

Stock Market Performance in Q1 2024

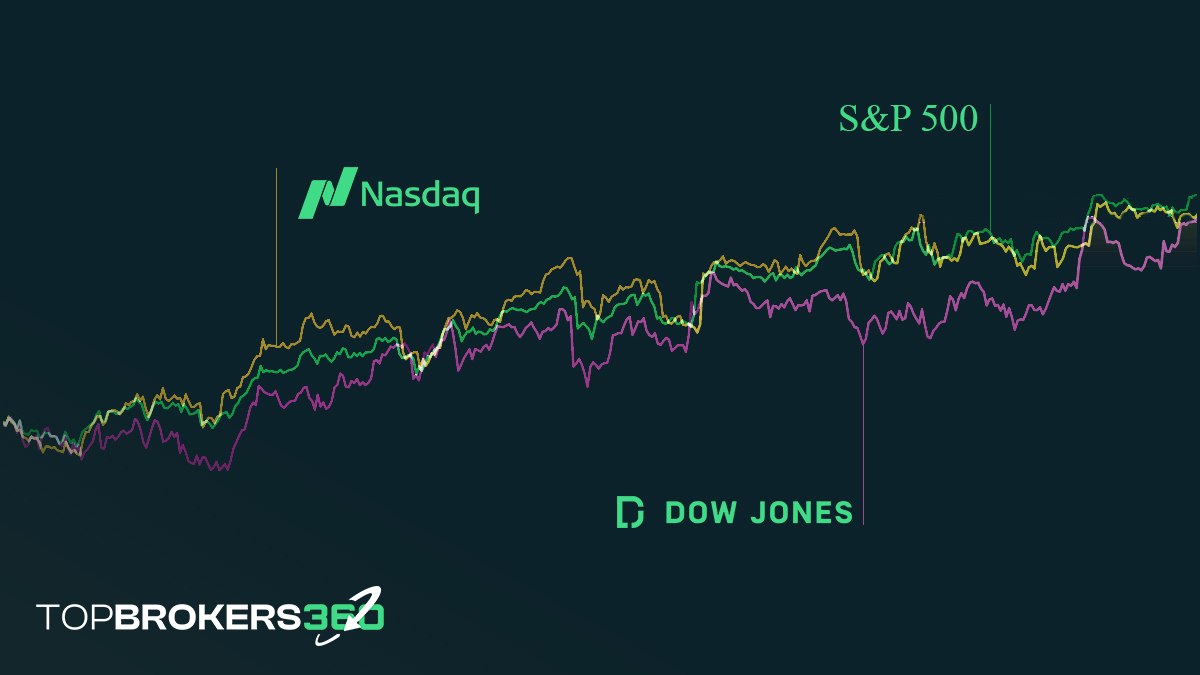

The opening quarter of 2024 has been a fascinating period for the stock market, with major indices such as the S&P 500, Dow Jones, and Nasdaq showcasing a mix of volatility and resilience.

Major Indices Overview

S&P 500: Demonstrated robust performance, boosted by positive economic signals and strong corporate earnings across various sectors, signaling investor confidence and market strength.

Dow Jones: Experienced a mix of ups and downs, reflecting the diverse outcomes in its component companies. Nonetheless, it managed to secure gains, highlighting the underlying market stability.

Nasdaq: Emerged as a star performer, thanks primarily to the tech sector's explosive growth. Advances in technology and increased investor interest in tech stocks propelled the Nasdaq to significant heights.

Driving Forces Behind Q1 Trends

Several factors contributed to the stock market's performance in the first quarter:

Economic Data: Indicators showing resilient consumer spending and manageable inflation levels helped uplift investor sentiment.

Earnings Reports: A majority of companies in key sectors met or exceeded earnings expectations, providing a boost to market confidence.

Tech Boom: The spotlight on AI and other technological advancements played a significant role, especially in elevating Nasdaq's performance.

Top Performing Sectors in Q1 2024

| Sector | Description |

| Technology | The clear frontrunner, with AI and tech innovation leading the charge. This sector's growth not only lifted the Nasdaq but also had a ripple effect across the market. |

| Consumer Discretionary | Benefited from increased consumer spending and confidence. Companies in this sector, especially those linked to e-commerce and digital services, saw substantial growth. |

| Financials | Showed resilience and growth amid changing interest rate expectations and economic conditions, with banking and financial services companies performing well. |

Spotlight on Tech Stocks: AI's Influence and Major Movers

Tech stocks, particularly those in the AI space, have been the stars of Q1 2024. The surge in interest and investment in AI technologies has not only fueled Nasdaq’s rise but also highlighted companies like Nvidia and new entrants that are pioneering the next wave of tech innovation.

These companies have seen their values soar as they lead the charge in developing cutting-edge AI solutions, attracting significant investor attention and reshaping market dynamics.

However, David Bahnsen, chief investment officer at The Bahnsen Group, expresses caution regarding the recent enthusiasm for tech stocks, comparing it to the dot com bubble. Q1 2024 has set a dynamic stage for the stock market, with technology leading the way and other sectors following closely. As we move into Q2, the momentum built by these sectors, especially tech, will be crucial in determining the market's direction in the face of ongoing economic developments and geopolitical factors.

Commodity Markets Overview

The first quarter of 2024 has been a standout period for commodities, with several key assets making significant moves. Gold, in particular, has shone brightly, reaching new heights, while oil and other commodities have also shown notable trends.

Gold's Remarkable Performance

Record Highs: Gold reached unprecedented levels in Q1, with prices soaring to all-time highs. A mix of inflation fears, geopolitical tensions, and shifts in monetary policy expectations has propelled this surge.

Driving Factors: Investors have flocked to gold as a safe haven amid uncertainty in the global economy. Additionally, the anticipation of rate cuts by major central banks has increased gold's appeal, as lower interest rates tend to reduce the opportunity cost of holding non-yielding assets like gold.

Oil and Other Commodities

Oil Trends: Oil prices experienced volatility in Q1, influenced by supply concerns, global demand forecasts, and geopolitical developments. While there were moments of significant price increases, overall, the oil market has faced a balancing act between supply adjustments and fluctuating demand.

Broader Economic Implications: The trends in oil and other commodities, such as natural gas and metals, have broader implications for the global economy. High commodity prices can contribute to inflationary pressures, affecting consumer spending and central bank policies.

Q1 2024 Highlights

Gold

Reached record high prices, driven by safe-haven demand and speculation about future monetary policy.

Oil

Showed volatility with concerns over supply and demand dynamics. Prices were influenced by OPEC decisions and global economic indicators.

Natural Gas

Experienced price fluctuations due to seasonal demand patterns and shifts in energy policy in key markets.

Metals

Industrial metals like copper saw prices affected by manufacturing data and supply chain adjustments, while precious metals like silver followed gold's upward trend.

The commodities market in Q1 2024 has been marked by significant activity, with gold leading the way in performance. The movements in these markets reflect a complex interplay of economic, geopolitical, and environmental factors. As we step into Q2, the trajectory of these commodities will continue to be a key indicator of global economic health and investor sentiment.

The Forex Market in Review

The first quarter of 2024 brought significant developments in the forex and bond markets, shaped by the US Federal Reserve's decisions and evolving economic conditions.

The US Dollar's Journey Through Q1

Federal Reserve's Influence: The Fed's monetary policy decisions, especially regarding interest rates, had a profound impact on the US dollar.

Economic Indicators: Data reflecting the US economic health, including employment figures and inflation rates, also played a crucial role in the dollar's performance, impacting investor sentiment and forex market dynamics.

➟ Compare the best Forex brokers to find the one that suits your trading style.

Key Forex Movements - Major Currencies vs. USD

| Currency | Key Influences |

| EUR (Euro) | ECB monetary policy, Eurozone economic recovery signs |

| JPY (Japanese Yen) | BOJ's policy adjustments, Japan's economic outlook |

| GBP (British Pound) | UK economic data, Brexit negotiations |

| CAD (Canadian Dollar) | Oil price trends, Bank of Canada's interest rate decisions |

| AUD (Australian Dollar) | Commodity export prices, RBA's policy stance |

The first quarter of 2024 has been a period of adjustment and anticipation in the forex markets, with investors keenly watching the Federal Reserve's moves and global economic indicators. The US dollar's performance against major currencies and the dynamics within the bond market highlight the interconnectedness of global financial systems and the importance of staying informed on monetary policy and economic trends.

The Crypto Landscape

The cryptocurrency market witnessed dynamic shifts and notable developments throughout the first quarter of 2024, characterized by evolving trends, the anticipation surrounding Bitcoin's halving, and significant price movements across various digital assets.

Bitcoin and the Cryptocurrency Market in Q1

Halving Anticipation: One of the most anticipated events in the crypto community was Bitcoin's upcoming halving, scheduled for April 2024. This event has garnered significant attention as market participants speculated on its potential impact on Bitcoin's price and market dynamics.

Price Movements: Bitcoin's price exhibited volatility during Q1, influenced by factors such as macroeconomic conditions, regulatory developments, and market sentiment. Despite fluctuations, Bitcoin maintained its position as the leading cryptocurrency, with its performance closely watched by investors and enthusiasts alike.

Ethereum and Altcoins Performance

Ethereum's Evolution: Ethereum, the second-largest cryptocurrency by market capitalization, experienced notable developments in Q1. The Ethereum network continued its transition to Ethereum 2.0, a significant upgrade aimed at improving scalability, security, and sustainability. Additionally, the growth of decentralized finance (DeFi) applications built on Ethereum contributed to its robust performance.

Altcoin Market: Alongside Ethereum, various altcoins exhibited diverse performance patterns in Q1. Some altcoins saw substantial price appreciation, driven by unique use cases, technological advancements, and community engagement. However, the altcoin market also faced challenges, including regulatory scrutiny and market volatility.

Q1 2024 Major Events

The crypto community eagerly awaited Bitcoin's halving, speculating on its potential impact on market dynamics and investor sentiment.

Ethereum 2.0 Progress

Updates on Ethereum's transition to Ethereum 2.0 garnered attention, highlighting the network's efforts to address scalability and sustainability challenges.

Regulatory Developments

Regulatory actions and statements from authorities worldwide shaped the regulatory landscape for cryptocurrencies, influencing market sentiment and investor behavior.

2024’s Q1 presented a dynamic and eventful period for the cryptocurrency market. As the crypto landscape continues to evolve, investors and enthusiasts remain vigilant, navigating market trends and regulatory developments to make informed decisions in this rapidly changing environment.

Impact of Global Economic Policies

The first quarter of 2024 saw significant developments in global economic policies, with central banks playing a pivotal role in shaping market dynamics and investor sentiment.

The Federal Reserve's Stance

Maintained Interest Rates: The Federal Reserve opted to keep its key interest rate steady throughout Q1, marking the fifth consecutive meeting without a change. "The economy is strong, inflation has come way down, and that gives us the ability to approach this question carefully and feel more confident that inflation is moving down sustainably at 2% when we take that step to begin dialing back our restrictive policy." Jerome Powell (Chair of the Federal Reserve)

Inflation Concerns: Despite persistent inflationary pressures, particularly in sectors like housing and services, the Fed refrained from immediate rate cuts. Fed Chair Jerome Powell emphasized the importance of achieving sustainable inflation while balancing the risks of adjusting rates too soon or too late.

Bank of Japan's Historic Pivot

End of Negative Rates: The Bank of Japan (BOJ) made a historic pivot in Q1 by ending its experiment with negative interest rates and unconventional easing tools. Instead, the BOJ introduced a short-term interest rate of 0.1% on financial institutions' account balances.

Domestic Economic Boost: This policy shift was influenced by factors such as a spike in base pay reported by Japan's largest trade union federation, aiming to stimulate domestic demand and inflation. The move marked a significant departure from the BOJ's previous monetary policy stance.

European Central Bank and Other Central Banks

Policy Impacts: Central banks worldwide closely monitored economic indicators and adjusted their policies accordingly. The European Central Bank (ECB) and other central banks maintained accommodative stances, with a focus on supporting economic recovery amidst lingering uncertainties.

Market Response: These policy decisions had varying impacts on financial markets, influencing asset prices, currency exchange rates, and investor sentiment. Market participants closely monitored central bank statements and economic projections for insights into future policy directions.

Global economic policies in Q1 of 2024 reflected central banks' efforts to navigate evolving economic conditions and address emerging challenges. While the Federal Reserve maintained its cautious stance amid inflation concerns, the Bank of Japan's historic pivot signaled a significant shift in monetary policy direction. Additionally, central banks worldwide remained vigilant, adjusting policies to support economic recovery and stability in their respective regions.

Q1 2024 Summary

As the curtains fall on Q1 2024, the markets have delivered a narrative rich with volatility, resilience, and innovation. The standout performances of tech stocks, driven by AI advancements, alongside significant movements in commodities like gold, paint a picture of a dynamic financial landscape. The quarter's developments, underpinned by strategic central bank policies and an evolving tech sector, have set a solid foundation for the upcoming quarter, highlighting the importance of adaptability and informed decision-making in the face of uncertainty.

Looking ahead, the anticipation around Bitcoin's halving, alongside central banks' nuanced approaches to inflation and economic recovery, suggests that Q2 2024 will continue the trend of unpredictability and opportunity. Investors and market enthusiasts are poised on the edge of their seats, eager to see how these narratives unfold in the ever-changing tapestry of the global financial markets.

➟ Read more about TopBrokers360 Q2 Predictions for 2024.

![Weekly Economic Overview [05.07.24]: S&P 500, NASDAQ, Tesla, and Apple](https://www.topbrokers360.com/wp-content/uploads/2024/07/Weekly_Update_Thumbnail_5.jpg)

![Weekly Economic Overview [28.06.24]: US Stock Market Trends, Inflation Insights, and NVIDIA Analysis](https://www.topbrokers360.com/wp-content/uploads/2024/06/Weekly_Update_Thumbnail_4.jpg)