Understanding Scams

Scams aren't new; they have been around as long as money itself. In the past, a scam might have been a dodgy deal in a market square or a fake land sale. But as we moved our lives and money online, scams got a digital upgrade.Forex Trading Scams: The Tech Makeover

Forex, or foreign exchange, is all about trading currencies. With a massive $7 trillion moving around every day, it's a playground for scammers. In the early days, a forex trading scam might have been a shady broker in a back alley. Now, with tech in their toolkit, scammers use fake websites and bots to trick traders. They promise huge profits with little risk, a classic sign that something is not right.Crypto Scams: Riding the Digital Wave

Crypto scams took off with the rise of Bitcoin and other cryptocurrencies. These scams are like the wild west, partly because crypto is new and exciting, and partly because it's a bit of a mystery to most people. Scammers use fake ICOs (Initial Coin Offerings) or promise to double your crypto if you send them some first. Remember, if it sounds too good to be true, it probably is.Stock Scams: Old Tricks, New Twists

Stock scams have been around since stocks were invented. Remember the "pump and dump"? Scammers hype up a stock (the pump), driving the price up. Then they sell their shares at this high price (the dump), and the price crashes, leaving everyone else with a loss. Nowadays, they use social media to spread rumors or fake news to pump stocks.Commodity Scams: The Overlooked Frontier

Commodities like oil, gold, or coffee have always been hot items for scams, especially in less-watched markets. A common scam is the "phantom shipment": scammers sell you a shipment of gold that doesn't exist. With less scrutiny in these markets, it is easier for scammers to slip through the cracks.

Common Types of Scams in 2024

In 2024, we must be aware of typical scams that can mislead even the most experienced investors. Let's break down these trade tactics across markets to make them easier to recognize and avoid.Forex Scams

- Unregulated Brokers: These entities operate without the oversight of regulatory bodies, making them risky to deal with as they might not offer the protections that regulated brokers do.

- Binary Options: A form of investment where traders bet on the movement of currencies. Many platforms offering binary options are scams with manipulated trading platforms designed to ensure the trader loses. It’s like betting on coin flips but the coin is rigged.

- Clone Firms: Scammers create firms that mimic legitimate ones, complete with similar names and branding, to deceive investors.

- Social Media Scams: Fraudsters use social media to promote schemes or fake investments by pretending to be successful traders or insiders.

- Scam Signal Providers: These are entities that claim to have insider information or infallible algorithms for predicting market movements, often for a fee.

Crypto Scams

- Fake ICOs: Initial Coin Offerings (ICOs) that are fabricated by scammers to collect funds without any intention of developing a real product or technology.

- Wallet Scams: Scammers trick individuals into giving away their digital wallet credentials or keys, leading to the theft of cryptocurrency.

- Pump and Dump: This involves artificially inflating the price of an owned cryptocurrency before selling it off at its peak to unsuspecting buyers.

Stock Scams

- Pump and Dump: Similar to crypto, but in the stock market, where stock prices are inflated through misleading statements before the scammers sell off their overvalued shares.

- Insider Trading Tips: Offering supposed insider information that can lead to unfair trading advantages and significant legal penalties for those involved.

- Boiler Room Sales: High-pressure sales tactics are used to coerce investors into buying stocks that are either worthless or significantly overpriced.

Commodity Scams

- Phantom Shipments: Deals or investments in commodities like oil or gold that do not actually exist, leading investors to put money into nonexistent projects.

- Investment Seminars: Seminars that charge high fees promising to teach investors how to make huge profits in the commodities market, often with little to no valuable information provided.

Spotting the Red Flags

Knowing what these scams look like is half the battle. Here are quick tips to keep in mind:- Lack of Regulation: Always verify the regulatory status of a company or broker.

- Unrealistic Promises: Be skeptical of guaranteed returns or promises of low risk and high reward.

- Pressure to Invest Quickly: Scammers often use urgency to push you into making hasty decisions.

- Requests for Personal Information: Be cautious if asked to provide sensitive information or money upfront.

- Complex Strategies: Scams may involve overly complicated investment strategies that are hard to understand.

Awareness and caution are your best defenses against scams in the financial markets. By staying informed and skeptical of too-good-to-be-true offers, you can navigate the investment landscape of 2024 more safely and successfully.

How to Protect Yourself from Forex Trading Scams in 2024

In the vast and volatile forex market, scams can sometimes shadow legitimate opportunities. However, knowing how to shield your investments can make all the difference. One of the most effective ways to protect yourself is to ensure you're dealing with regulated brokers. Here’s how to go about it:Regulation is Key: Identifying Regulated Brokers

- Understand Regulation Importance: A regulated broker means it's overseen by financial authorities, adhering to strict standards that protect traders. This oversight helps ensure transparency and fairness, reducing the risk of scams.

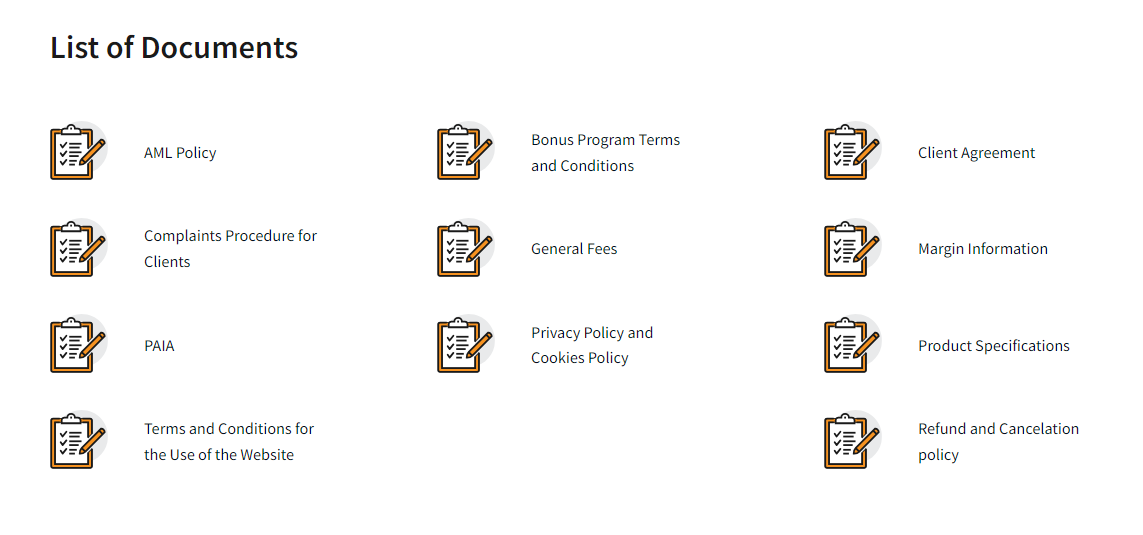

Image source: Transparent brokers like FXNovus keep all their regulatory documents front and center.

What is a Regulated Broker?

- License and Registration: Legitimate brokers should have their licensing information readily available. This includes the regulatory body overseeing them and their license number. Brokers like Maunto, AvaTrade, and Forex.com all have strict regulations which they adhere to.

- Reputation and History: Look for brokers with a solid reputation and track record. Long-standing operations with positive feedback from traders are usually a good sign.

- Financial Protection Measures: Regulated brokers often offer protection measures such as segregated client accounts, which keep your funds separate from the broker’s operational funds, adding an extra layer of security.

- Clear Terms and Conditions: Transparency in terms and conditions, including fees, spreads, and leverage options, is a hallmark of reputable brokers. This is the case with brokers like ModMount and BlackBull Markets. Any ambiguity should be considered a red flag.

How to Verify Regulatory Status and Trust Score Ratings

- Check the Regulatory Body’s Website: Once you have the broker's licensing information, visit the website of the regulatory body to confirm the broker is listed. This step is crucial as scammers can fake license numbers.

- Use Independent Verification Services: Websites and platforms independent of brokers often provide verification services for regulatory status and trust scores. Trust scores aggregate various factors including regulation, client reviews, and company longevity to provide a reliability rating.

- Review Financial Authority Warnings: Financial authorities frequently publish warnings about unlicensed brokers and those involved in scams. Regularly checking these alerts can prevent you from falling victim to a new or emerging scam.

Safeguarding Investments in 2024

Here’s how you can protect your investments in 2024:Educational Resources and Tools

- Stay Informed: Continuous learning is your first line of defense. Dive into books, online courses, and webinars about trading and investment strategies, focusing on identifying scams.

- Use Analytical Tools: Leverage tools that analyze market trends and provide data-driven insights. These can help you make informed decisions and spot inconsistencies typical of scam operations.

- Participate in Forums: Engage in trading forums and communities. These platforms often share firsthand experiences and warnings about scams, offering a collective knowledge base.

Regulatory Bodies and Trustworthy Platforms

- Regulatory Oversight: Regulatory bodies enforce standards that protect investors. Familiarize yourself with organizations like the Securities and Exchange Commission (SEC), the Financial Conduct Authority (FCA), the Financial Sector Conduct Authority (FSCA) or the Australian Securities and Investments Commission (ASIC).

- Choose Regulated Platforms: Only trade with platforms regulated by reputable authorities. These platforms adhere to strict guidelines, ensuring fair trading practices and security for your investments.

- Verification Tools: Utilize online tools provided by regulatory bodies to verify the registration and licensing of brokers and trading platforms. This can include checking through official regulatory websites or using third-party verification services.

Smart Trading Practices

- Diversify Your Investments: Don’t put all your eggs in one basket. Spread your investments across different asset classes (stocks, forex, crypto, commodities) to mitigate risks. Diversification can protect you from the volatility of individual markets.

- Use Demo Accounts: Before committing real money, practice with demo accounts. They not only help you get accustomed to the trading platform but also allow you to verify the legitimacy and performance of trading strategies without financial risk.

- Conduct Due Diligence: Before making investment decisions, conduct thorough research. This includes reading up on the markets you are interested in, understanding the risks involved, and scrutinizing any investment opportunity or broker.

- Set Clear Goals and Limits: Know what you’re investing for and set clear, achievable goals. Equally important is setting limits on how much you are willing to risk. This discipline can help you avoid making impulsive decisions based on unrealistic promises.

In 2024, as the allure of quick gains continues to tempt investors, arming yourself with knowledge, using the right tools, and adopting smart trading practices are key to navigating the markets safely. Remember, the goal is not just to grow your investments, but to protect the wealth you're working hard to build.

![Weekly Economic Overview [05.07.24]: S&P 500, NASDAQ, Tesla, and Apple](https://www.topbrokers360.com/wp-content/uploads/2024/07/Weekly_Update_Thumbnail_5.jpg)

![Weekly Economic Overview [28.06.24]: US Stock Market Trends, Inflation Insights, and NVIDIA Analysis](https://www.topbrokers360.com/wp-content/uploads/2024/06/Weekly_Update_Thumbnail_4.jpg)