A TopBrokers360 TeleTrade Review for 2024

Established in 1994, TeleTrade has grown to become well-known to traders seeking reliability and a wide array of trading options in the Forex market. With its commitment to offering sophisticated trading platforms like MetaTrader 4 and MetaTrader 5, alongside a proprietary analytics app, the broker equips its clients with the tools necessary for a fruitful trading experience. This TeleTrade review aims to shed light on the broker's features, services, and how it stands as a distinguished choice for traders around the world.

➟ Get More Inspiration and Insights into Trading with our TopBroker360 Guides.

Pros and Cons

Pros:

- Extensive Trading Platforms

- Multiple Account Types

- VIP Client Services

- Global Market Access

- Award-Winning Broker

Cons:

- Limited Educational Resources

- Restricted in Some Countries

TeleTrade Trading Platform Review

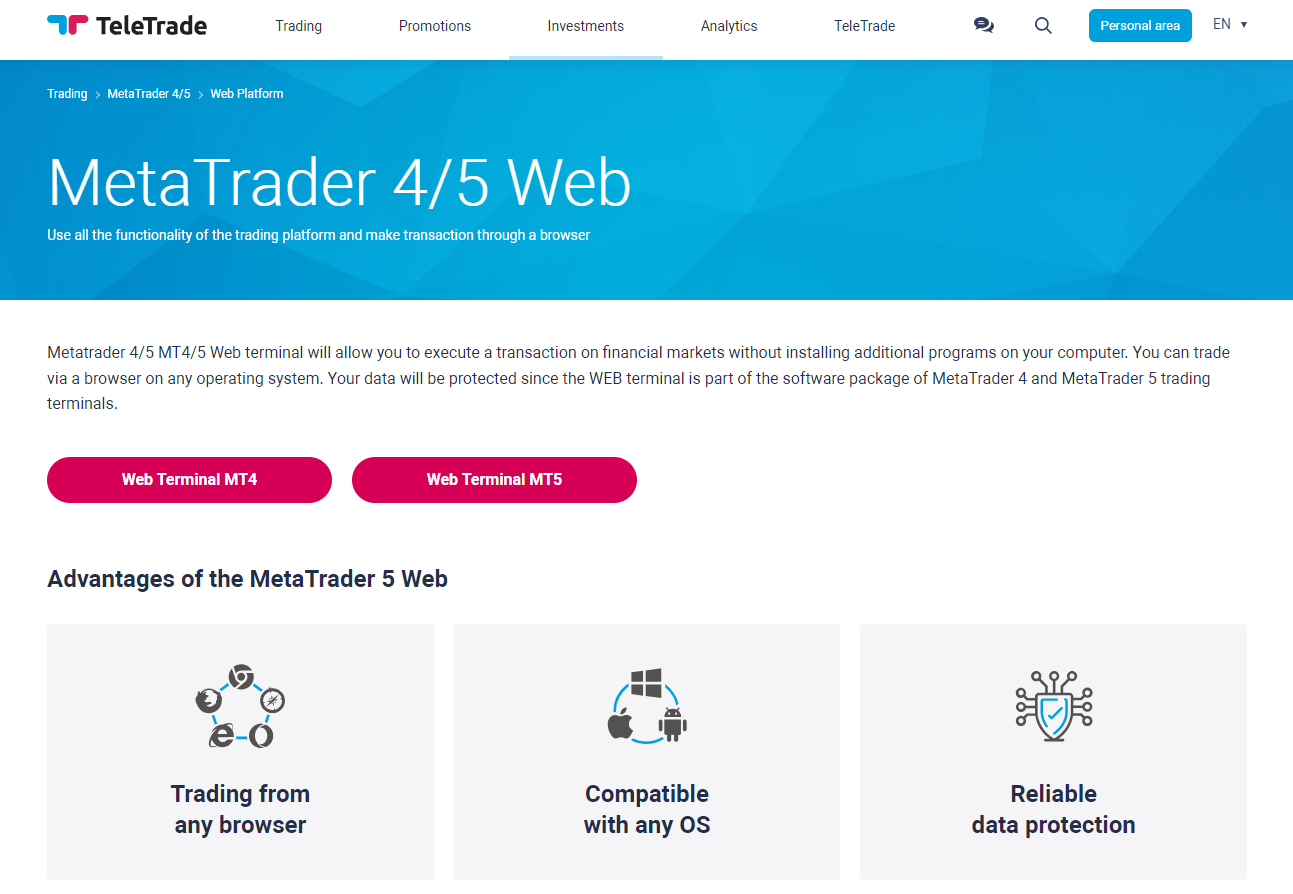

The broker offers a wide selection of trading platforms to accommodate every trader's needs, highlighted by the versatile MetaTrader 4 and MetaTrader 5 suites. These platforms are accessible via the web, allowing trading directly from any browser without the need for additional software, and are compatible across various operating systems, ensuring ease of access and security. For those who prefer desktop solutions, TeleTrade provides MT4 and MT5 for Windows, offering a native, feature-rich trading experience. Mobile traders aren't left behind, with dedicated apps for iOS and Android devices enabling trading on the go.

Each platform variant is equipped with tools and features designed to enhance the trading experience, from technical analysis indicators to economic calendars, ensuring traders have everything they need to make informed decisions.

Image Source: TeleTrade’s MetaTrader ⅘ Web Trading Platforms

➟ Find out More About TeleTrade’s Trading Platforms.

- Browser-Based Trading Without Installations

- Cross-Platform Compatibility

- Secure Data Protection Measures

- One Click Trading Functionality

- 30 Technical Analysis Indicators

- Real-Time Market Quotes

- Comprehensive Trading History Access

- Economic Calendar Integration

- Trading and Demo Account Options

- Mobile Trading on Android and iOS

TeleTrade’s Market Offerings

Image Source: Product Offerings by TeleTrade

TeleTrade distinguishes itself in the financial markets by offering a wide selection of trading instruments, catering to the diverse interests and strategies of traders worldwide. From the volatility of Forex pairs to the solidity of precious metals, and the innovative allure of cryptocurrencies, the broker provides its clients with the tools necessary for engaging various markets. This selection ensures traders can diversify their portfolios within a single platform, aligning with both short-term trading strategies and long-term investment goals. The inclusion of indices and energy instruments further broadens the scope for traders looking to capitalize on global economic trends and energy market dynamics.

Instruments:

- Forex: TeleTrade offers 61 currency pairs, covering major, minor, and exotic currencies for a broad forex trading experience.

- Indices: Access to major global indices is provided, enabling traders to speculate on worldwide economic trends.

- Cryptocurrencies: A selection of popular cryptocurrencies, including Bitcoin, allows for dynamic trading in the digital currency market.

- Precious Metals: Opportunities to trade in gold and silver, serving as potential safe havens or hedge options.

- Energy Commodities: Includes oil and gas, offering traders ways to engage with the energy sector's market dynamics.

- Stocks: A wide range of global companies' stocks is available, allowing for direct investment in various industries.

- ETFs and CFDs: Broad market access is facilitated through a diverse range of ETFs and CFDs, enhancing portfolio diversification.

Comparing the Trading Accounts

➟ Practice Trading with a TeleTrade Demo Account

The broker takes its platform offering seriously, catering to a broad spectrum of traders with a variety of MetaTrader platforms and account types.

Here's a quick overview:

MetaTrader 5 - ECN: This platform is ideal for traders looking for direct access to market prices and depths. The ECN (Electronic Communication Network) version of MT5 provides high-speed trading execution, making it perfect for scalpers and day traders.

MetaTrader 5 - Invest: Tailored for investors looking to delve into the markets without executing trades themselves. This platform facilitates copy trading, where users can mirror the strategies of seasoned traders.

MetaTrader 4 - NDD: The Non-Dealing Desk version of MT4 offers traders transparent trading with real-time prices and no re-quotes. It's designed to eliminate potential conflicts of interest between the broker and traders.

MetaTrader - CENT: A unique offering for beginners or those looking to trade with lower stakes. Trades are executed in cent denominations, reducing the risk while providing the full MetaTrader experience.

Demo Account: For those new to trading or looking to test strategies without financial risk, TeleTrade offers a demo account across its MetaTrader platforms. This feature allows traders to get acquainted with the platforms and practice trading in a simulated environment.

Is TeleTrade a Trusted Broker?

➟ Review the regulatory credentials of TeleTrade

TeleTrade operates with a strong commitment to regulatory compliance, ensuring a secure and trustworthy trading environment for all its clients. As a broker regulated by the Cyprus Securities and Exchange Commission (CySEC), the broker adheres to stringent European regulatory standards, including ESMA guidelines. This regulatory oversight ensures that the highest level of operational integrity is maintained with client fund protection and transparency. By prioritizing the safety and interests of its traders, TeleTrade establishes itself as a reliable and respected entity in the global Forex market.

TeleTrade Payment Methods

TeleTrade simplifies the funding process for its traders with a straightforward range of payment methods. With a minimum deposit requirement of $100, traders can utilize bank wires, credit/debit cards, Neteller, Skrill, and FasaPay for both deposits and withdrawals. While the processing times and potential fees vary depending on the chosen payment processor, TeleTrade strives to offer efficient and secure options for managing financial transactions. Although not the most cost-efficient across all brokers, the available methods meet the needs of the majority of traders, ensuring a smooth trading experience.

Exploring TeleTrade's Customer Service Team

TeleTrade's support framework impresses with its variety, ensuring traders can access help through multiple channels. With options ranging from real-time chat for immediate queries to email support for detailed inquiries, all bases are covered. The broker also facilitates direct phone support, providing a personal touch for those seeking voice conversation. Additionally, the callback request feature adds convenience, allowing traders to schedule a call at a time that suits them best. This multi-channel approach to support ensures that regardless of the trader's preference or need, TeleTrade is readily available to assist, reinforcing its commitment to customer satisfaction.

Email:

[email protected]

Telephone:

+442080895636

Wrapping Up our Broker Review

TeleTrade stands out in the Forex trading industry, backed by a series of awards that underscore its commitment to quality, reliability, and excellence. These accolades highlight the broker's dedication to superior customer support, rich educational resources, and a comprehensive trading environment suitable for all traders. From its user-friendly trading platforms to its insightful market analysis and dependable customer service, TeleTrade consistently prioritizes its clients' success and satisfaction.

Choosing TeleTrade means partnering with a broker whose recognized achievements reflect its ability to empower traders. With a focus on fostering a supportive trading experience, TeleTrade continues to be a preferred choice for traders looking for a trusted and accomplished broker to navigate the financial markets.

Frequently Asked Questions

1. Is TeleTrade a good broker?

TeleTrade has established itself as a reputable broker since its inception in 1994, offering a wide range of trading instruments and platforms. With its great support, educational resources, and a variety of account types, it caters well to both beginner and experienced traders. The broker's commitment to quality is further emphasized by its numerous industry awards.

2. Is TeleTrade regulated?

Yes, the company is regulated by the Cyprus Securities and Exchange Commission (CySEC), adhering to strict European regulatory standards. This ensures that the broker operates with transparency and integrity, offering a secure trading environment for its clients.

3. Which is the best platform for trading?

The broker offers the renowned MetaTrader 4 and MetaTrader 5 platforms, which are widely considered among the best for Forex and CFD trading. Both platforms provide advanced trading features, and analytical tools, and are highly customizable to fit the trader’s needs. The choice between them depends on the individual's trading style and preferences.

4. Can I trade cryptocurrencies with TeleTrade?

Yes, TeleTrade offers trading in a selection of the most popular cryptocurrencies, allowing traders to diversify their portfolios beyond traditional Forex and commodities markets.

5. Is there a way to test trading strategies with TeleTrade without risk?

Demo accounts are provided that simulate real market conditions, enabling traders to test strategies and gain experience without any financial risk. This feature is particularly beneficial for beginners and those looking to try out new tactics.

6. How does TeleTrade keep its traders informed?

Daily market commentary, economic calendars, and Forex news are offered to keep its traders well-informed about the latest market trends and news, helping them make timely and informed decisions.

7. What kind of educational resources does TeleTrade offer to enhance trading skills?

The broker invests in trader education by offering webinars, seminars, and comprehensive training materials designed to enhance trading skills and knowledge across all levels of experience.

8. Are the broker’s trading platforms mobile-friendly?

Yes, TeleTrade ensures that its traders can access the markets on the go by providing mobile versions of the MetaTrader 4 and MetaTrader 5 platforms, compatible with both Android and iOS devices.

9. Is TeleTrade a Forex broker?

Yes, TeleTrade is a well-established Forex broker that also provides a wide range of other financial instruments for trading, including cryptocurrencies, stocks, indices, and commodities.

➟ Ready to explore more? Check out more broker reviews to find your perfect trading partner today!